Information brought to you by

*As of July 2022, Get My Payment Illinois is not regularly updating this website. The information provided here is current through June 30th, 2022 and is relevant to stimulus money made available during 2020 and 2021. These funds can be claimed until April 2024 (stimulus checks 1 and 2) and April 2025 (stimulus check 3 and expanded Child Tax Credit).

Make sure you claimed and received all available stimulus funds!

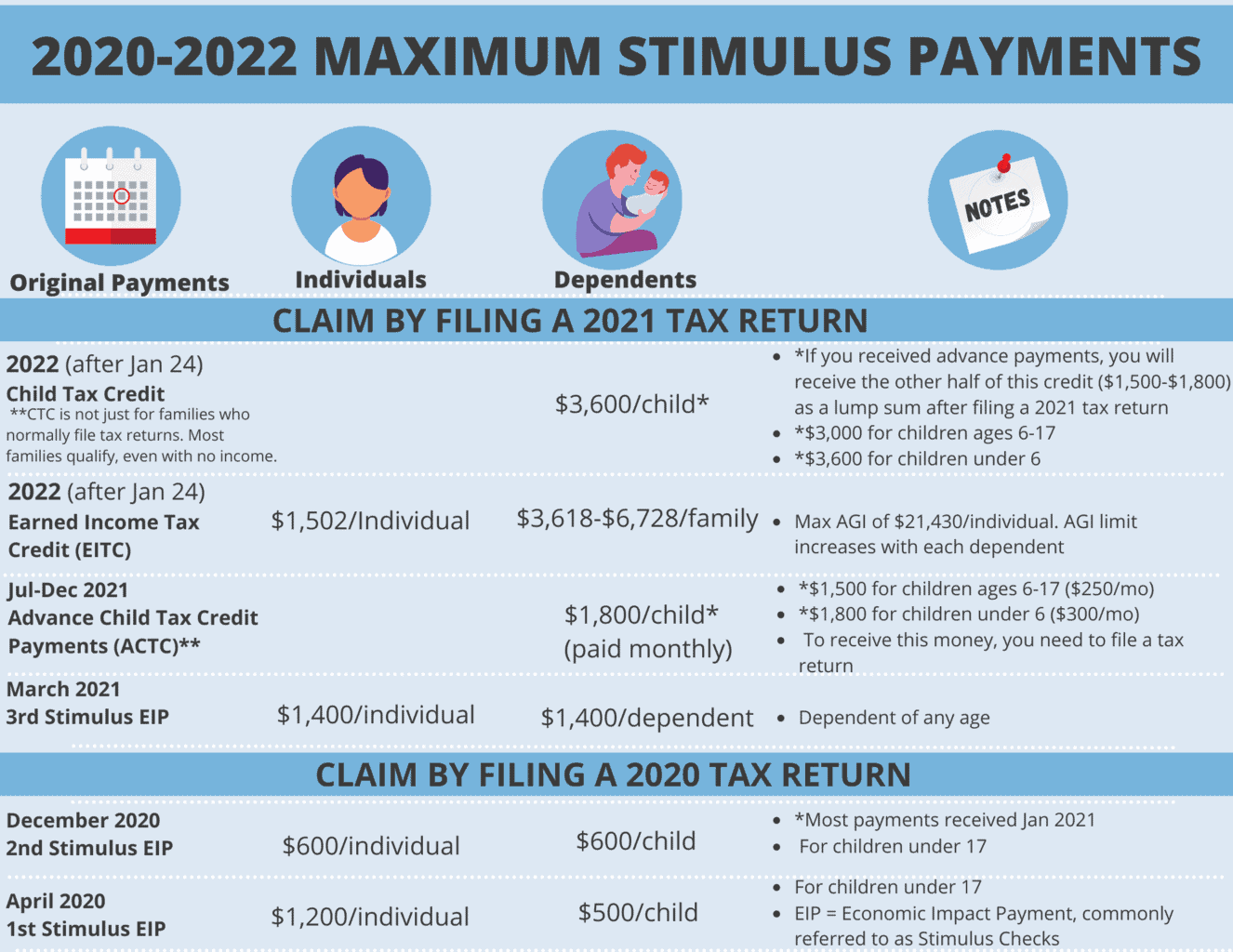

Thousands of dollars of federal stimulus money were made available for the 2020 and 2021 tax years, even for people who don't normally file taxes. Credits may be claimed for up to 3 years after the original tax filing deadline, so make sure you received all available funds.

The Earned Income Tax Credit (EITC) and Child Tax Credit (CTC) were available to more people than ever before in 2021. It's not too late to claim stimulus money!

The State of Illinois will be issuing “rebate checks” to taxpayers from July 2022 through October 2022. Make sure you have filed an Illinois 1040 form before October 17, 2022 to receive your check, even if you don’t have any income. Checks will be for $50/individual and $100/child up to three children, for a maximum rebate of $400.

If you have children and received a monthly check from the IRS during the second half of 2021, you must file a 2021 tax return to claim the other half of your Child Tax Credit.

Even if you don’t have children, you may be eligible for increased money from the Earned Income Tax Credit.

*File for free at GetYourRefund.org/IL or MyFreeTaxes.com or visit GoLadderUp.org

See below to make sure you received all of the federal money you qualified for.